Cashflow margin

A company will record 2000 in depreciation expenses for that asset each of the five years. Explanation of Cash Flow Margin.

Cash Flow Formula How To Calculate Cash Flow With Examples

This is helpful in comparing the free cash situation of different companies.

. Its operating margin is 5000001 million or 50. Free cash flow margin simply takes the FCF and compares it to a companys sales or revenue. Calculating the operating cash flow margin is a four-step process.

Also called Operating Cash Flow Margin and Margin Ratio the Cash Flow Margin measures how well a companys daily operations can transform sales of. Free Cash Flow. Ad Interactive Brokers offers some of the lowest margin rates compared to our competitors.

Margin rates as low as 283. Operational leverage This term refers to how a business owner can increase their operating income via increased revenue. Ad QuickBooks Financial Software.

Rated the 1 Accounting Solution. Operating Margin Example. Step 2 Calculate Net Revenue.

Net profit margin Revenue cost revenue. Best performing Sectors by Cashflow Margin Quarterly Includes every company within the Sector. Ad Interactive Brokers offers some of the lowest margin rates compared to our competitors.

Margin rates as low as 283. Operating cash flow tracks the cash flow generated by a business operations ignoring cash flow from investing or financing activities. Rates subject to change.

925000 during same period We now have the numbers needed to calculate free cash flow margin. Rates subject to change. Cashflow Margin Quarterly Screening as of Q2 of 2022.

The formula for calculating the cash flow margin itself is net income plus non-cash. For example say a company has an operating income of 500000 and net sales of 1 million. The operating cash flow margin of 63 is above 50 which is a good indication that the company is efficiently creating operating cash from its sales.

The Cash Flow Margin Calculator is used to calculate the cash flow margin. Step 1 Calculate Cash Flow from Operating Activities. Cashflow Margin Quarterly ranking list of best performing Industries Sectors and Companies - CSIMarket.

Cash Flow Margin Definition. Step 3 Divide Operating Cash. Detailed cash flow statements for Microsoft MSFT including operating cash flow capex and free cash flow.

Cash flow margin is a measure of the money a company generates from its core. Free cash flow margin measures the true economic profitability and cash-generating power of a business and is simply the number of pennies of FCF a company. Operating cash flow margin is a profitability ratio that measures your businesss cash from operating activities as a percentage of your sales revenue over a given period.

Mizvjx2w2abqnm

Cash Flow Ratios To Analyze Cash Sufficiency Of Companies Getmoneyrich

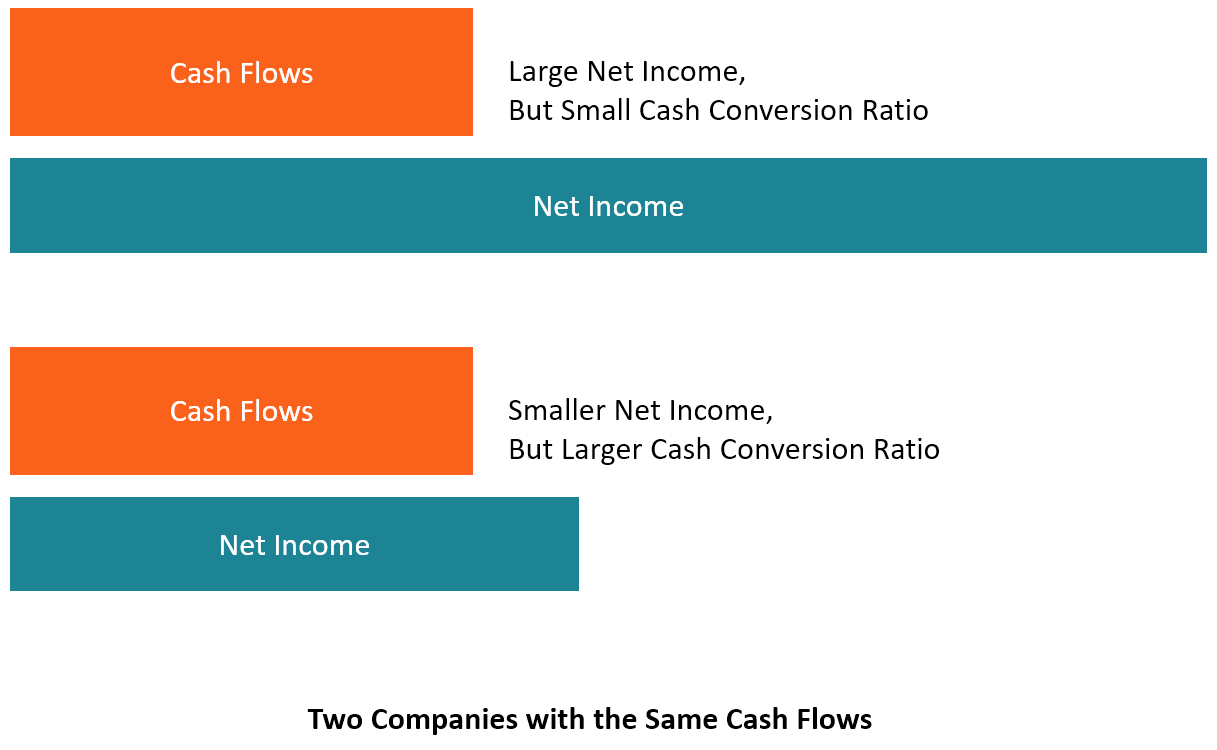

Cash Conversion Ratio Comparing Cash Flow Vs Profit Of A Business

Profit Margin Formula And Ratio Calculator Excel Template

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-369e05314df242c3a81b8ac8ef135c52.jpg)

Free Cash Flow Fcf Formula To Calculate And Interpret It

Summary Of Economic Margin Obrycki Resendes Abstract

Operating Cash Flow Formula Examples With Excel Template Calculator

Financial Ratios Statement Of Cash Flows Accountingcoach Financial Ratio Cash Flow Statement Financial

Fcf Yield Unlevered Vs Levered Formula And Calculator Excel Template

Cash Flow Statement Definition Example And Complete Guide Fourweekmba

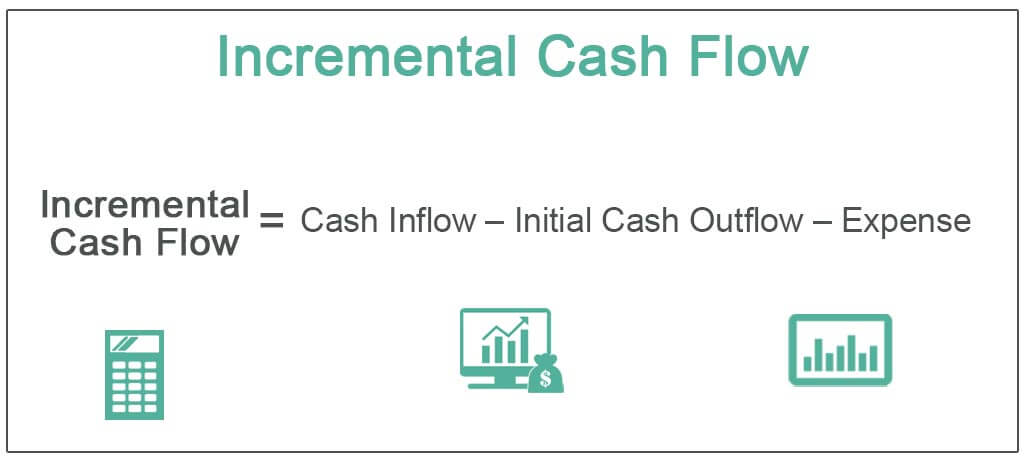

Incremental Cash Flow Definition Formula Calculation Examples

Cash Flow Ratios To Analyze Cash Sufficiency Of Companies Getmoneyrich

Operating Cash Flow Margin Formula Calculator Updated 2022

/GettyImages-490024232-ce77fc165c6147d2a4a6fa1c28824297.jpg)

What S More Important Cash Flow Or Profits

Cash Flow Statement Analysis Double Entry Bookkeeping

Cash Flow Adequacy Ratio Formula And Calculator Excel Template

Cash Flow Formula How To Calculate Cash Flow With Examples